BMM 2025 TRIBE SLATE

Projects represented at

Market(s) & Festival(s) — seeking Distribution • Pre-Sales • Co-Pro • Financing

Bespoke Media Marketing curates bold, market-ready stories and connects them with the right buyers, platforms, and partners. Request screeners, decks, or meetings via the contact at the bottom.

Animated Feature

Kids & Family Adventure

Genre

Coming-of-Age / Fantasy Adventure | Audience: Kids & Family | Delivery: November 2025

Logline

Best friends Lucky & Tanyia are pulled into a luminous realm by Nila, a mystical guide. Their quest tests loyalty, courage, and the magic of true friendship.

Budget:

$5M — fully financed

Format/Specs

Feature Film (CG) • Unreal Engine real-time pipeline

Hooks:

Unreal Engine, real-time animation → faster localization & versioning, sequel/series runway.

Heart-first, best-friends adventure with a toyetic creature (Nila) and clear licensing potential.

Vibrant, luminous world-building designed for premium trailers, character posters, and cut-downs.

Family co-viewing appeal; values-driven themes (loyalty, courage, friendship).

Status:

Post-production (final delivery November 2025)

Rights & Deal Terms:

Worldwide (all distribution rights available) Sri Lanka Carve out

IP Retained: Film copyright, characters, and franchise rights remain with producer.

Rights Offered: Distribution/Acquisition by territory/term (theatrical, TV, SVOD/AVOD; WW or regional). Merch, publishing, games excluded unless separately licensed.

Holdbacks/Windows: Platform-appropriate (e.g., theatrical → TVOD/EST → SVOD/AVOD).

Financials: MG + P&A strategy per territory; standard reporting & audit.

Approvals/Consultation: Credits approval; meaningful consultation on trailers, key art, and dubbing.

Delivery/Assets: Full feature deliverables + M&E, dialogue lists, captions; localization assets licensed for the Term only.

Reversion: Non-payment of MG by due date; no release within 12 months of delivery; insolvency.

Asks:

Distribution / Acquisition (theatrical, streamer, and TV)

Market(s)

MIPCOM (Kids/Animation), AFM, Annecy Animation Festival, Cartoon World

Localization readiness

Unreal-based pipeline; captions/dubs for 10+ languages; text-light UI for fast subtitling.

Deliverables

4K/UHD + HD masters, 5.1 + 2.0, M&E, stems, CC/SDH, dialogue lists, TRT sheets, artwork suite.

Book to Screen

STEM Preschool Animated Series

Genre:

Friendship • Discovery • Nature STEM

Logline:

A tiny but mighty sapling named SAP discovers his “Super Awesome Powers” and learns that even the smallest voice can make a mighty impact in a vibrant Baobab Tree community filled with teamwork, friendship, and discovery.

Audience:

Ages 1–5

Format / Production Notes:

Self-contained 11’ stories; soft-serialized worldbuilding.

2D or stylized 3D pipeline; simple rigs for expressive faces and broad gestures.

Localization-friendly (minimal on-screen text; songs with easy rhyme schemes).

Asks:

Distribution / Pre-sales, co-production partners (kids’ animation), music/localization partners, publishing & L&M conversations.

Status:

Development (concept bible + pilot outline in progress)

Rights & Deal Terms:

IP Retained: Series IP, characters, and franchise; Publishing and L&M managed by producer unless separately licensed.

Rights Offered (TV/Streaming): Exclusive kids TV/streaming license by territory/term (26×11’).

Rights Offered (Publishing): Picture-book and coloring/activity licenses by language/territory/term with royalty; co-editions welcome.

Holdbacks/Windows: TV/streaming windows per territory; publishing timed to series beats.

Financials: TV: pre-sales/commission + co-pro; Publishing: royalty + advance per format/territory.

Approvals/Consultation: Style guide adherence; approvals on key art, localization, and product safety (for L&M).

Delivery/Assets: TV deliverables + M&E; Publishing: print-ready files on approval; assets licensed for the Term only.

Reversion: TV: non-release within 12–18 months of delivery/payment default. Publishing: reversion for out-of-print, minimum sales, or payment default.

Series DNA / Hooks

Big feelings for little viewers: gentle, cozy adventures with clear social–emotional learning beats.

Nature STEM made simple: curiosity about trees, seasons, habitats, and “how things grow” (age-appropriate).

Repeatable play-pattern: “SAP checks in → tries → learns → shares” for easy episode cadence.

Colorful, toyetic world: Baobab setting + friendly characters (e.g., Baba Baobab, pals like Sap Xylem & Sap Phloem).

Music & movement moments: short call-and-response songs that invite participation.

Educational Goals (E/I-friendly):

SEL: naming feelings, turn-taking, teamwork, empathy, asking for help.

Early Science: living/non-living, needs of plants/animals, weather/seasonal change, simple cycles.

Language: vocabulary around nature and community; gentle problem-solving talk.

Budget (indicative):

$180–230K per 11’ (2D premium) — $4.7–6.0M season (26×11’)

Funding / Co-Pro / Pre-Sales:

Treaty co-pro with pubcasters at core; soft money 25–40%, pre-sales 15–25%, distributor advance + gap 10–25%, equity 10–20%. Publishing & L&M licensed separately.

Market(s)

MIPCOM, MIPJr, Annecy, Cartoon World, Cartoon Business

Book to Screen

Requiem for Betrayal by Ephraim Clark

Genre

Espionage Thriller / Political Noir | Setting: Paris, 1973

Logline:

In 1970’s Paris, semi-retired CIA contractor turned nightclub owner Brad James is thrust back into the dangerous world of espionage upon learning of the brutal murder of a close friend and colleague. As Brad covertly looks into his friend’s suspicious death, he uncovers an intricate international web of terrorism, murder, and revenge that is rapidly spinning out of control.

Budget

Est. $8M season (~6×50’)

Format

8×60

Hooks:

Nightclub-as-intel nexus → built-in episodic engine (performance = surveillance)

Political noir in iconic Paris ’73 with fashion/music/cold-war intrigue

Emotion-forward spy story (grief → purpose) with premium tone

Elevated comps: The Bureau, Babylon Berlin, The Night Manager

Status:

Pre-development (IP optioned; bible/beat sheet/lookbook in progress); EU co-pro + tax credit path in planning)

Rights & Deal Terms

IP Retained: Underlying novel by Ephraim Clark and all character/world rights remain with rightsholder/producer.

Rights Offered (License): Exclusive TV/Streaming (series) rights by territory and term (standard 7–15 years). Feature remake, publishing, games, and merch excluded unless separately licensed.

Holdbacks/Windows: To be set per territory (e.g., home video/TVOD holdback).

Financials: MG + pre-sales/co-pro finance; waterfall & audit rights standard.

Approvals/Consultation: Credits approval; meaningful consultation on trailers, key art, and localization.

Delivery/Assets: Standard deliverables + M&E; localization assets licensed for the Term only.

Reversion: Rights revert for non-payment of MG by due date, failure to commence exploitation/release within 12–18 months of delivery, or buyer insolvency.

Territory Rights:

Worldwide distribution rights available by territory/term; underlying IP retained by producer/author.

Financing/Co-Pro Path:

Equity + tax-incentive financing with EU co-pro partner(s); EP/showrunner attachments in progress; post-incentive budget target available under NDA.

Market(s)

Markets: MIPCOM Cannes

Detailed top sheet and post-incentive targets available under NDA.

Book to Screen

Mignon Samuels Trilogy by Nea Anna Simone

Genre

THE SALT LINE — One-Hour Prestige Thriller • Supernatural Family Drama • 10×60

Logline

Targeted by her husband and corrupt therapist, a mother taps an ancestral craft to turn the hunters into the hunted before the clock runs out.

Format:

Ongoing series • Season 1 target: 8 – 10×60

Series Overview

Set in a modern cosmopolitan city, The Salt Line is an action-driven survival thriller with roots in the haunted American South. An ancestral journal—passed through generations of Root women—becomes Mignon’s playbook and weapon, turning flight into counter‑attack.

As earthly and spiritual forces close in across courtrooms, corridors of power, and city streets, she must master the legacy fast, outmaneuver a charismatic abuser, and keep her family alive. It’s a kinetic blend of pursuit, cover‑ups, legal/political pressure, and escalating spiritual warfare—anchored by the unbreakable bond of Black matrilineal power.

Hooks

Ancestral journal = series engine. Each episode unlocks a page—new rite, new reveal—driving plot and mythology forward.

Psychological thriller × Southern Gothic mysticism. Real-world abuse/conspiracy collides with rooted spiritual power (uwe/uoi) for a fresh genre blend.

High stakes: a mother’s war. Survival story with urgent, universal stakes—three children to protect—keeps empathy and tension maxed.

Black matrilineal power at the center. A prestige canvas of Root women, legacy, and lineage rarely seen at this scale.

Villainy with proximity. Husband + therapist collusion makes the threat intimate, credible, and impossible to ignore.

Clear multi-season trajectory. S1 escape & expose → S2 reclaim & confront → S3+ legacy & guardianship—built for renewal.

Rules with a cost. Magic is limited, lineage-bound, and expensive—every use has consequences (dramatic fuel, not a cheat).

Location-flexible production. Southern setting sold via flashbacks/pickups; primary photography can be NJ or international to maximize incentives.

Cinematic ritual & vision language. Repeatable, elevated visual motifs (journal marginalia, sound-led rites) for trailer-ready moments.

Proven EP heat. Samad Davis (Kings of Jo’Burg, Netflix Global Top 10) attached signals premium intent and market credibility.

IP with history. Based on a long-loved book trilogy—built-in audience and press angles.

Executive Producer (Attached):

Samad Davis (Kings of Jo’Burg — Netflix Global Top 10)

Series Engine & Seasonal Trajectory:

Season engine: Mignon’s mastery of Root legacy vs. escalating earthly & spiritual antagonists.

S1: Escape & survival — expose the conspiracy, protect the children.

S2: Reclaim & confront — legal/political/spiritual fallout.

S3+: Legacy & guardianship — broader Root network; larger occult/power web.

Budget & Finance:

$28–35M season ($2.8–3.5M/ep). S2+ can realize 5–10% savings via amortized sets/assets.

Finance path: Equity + tax incentives; select territory pre-sales; distributor advance. Top sheet under NDA.

Rights & Deal Terms:

License only — IP retained. Exclusive TV/Streaming by territory/term (7–15 yrs).

Buyer ROFN/RON on future seasons tied to performance; reversion for non-payment or non-release within 12–18 months; hiatus protections for long gaps.

Market(s)

MIPCOM, AFM, Marche Du Film

Locations & Incentives:

Production is location-flexible. Primary photography can be mounted outside the U.S. or in New Jersey (transferable credit; NYC crew access).

The Southern setting is storyworld—handled via flashbacks/pickups and can be doubled on controlled exteriors or stage.

Short-list: NJ , GA (US) • Canada (ON/NS/MB) • Ireland/Portugal/Spain • Romania/Hungary/Czechia • South Africa

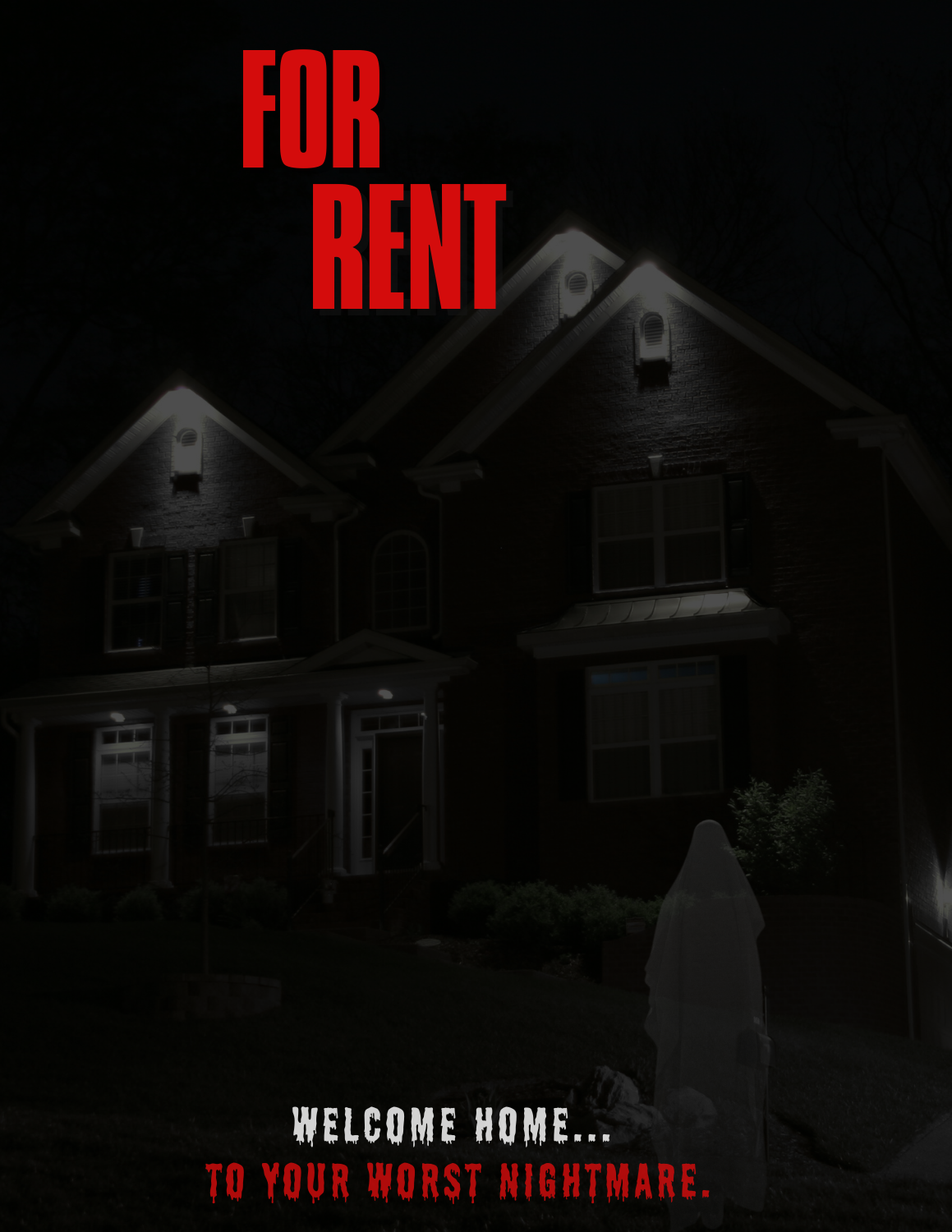

Feature

Horror

Genre

Feature Film (Horror / Tech-Noir)

Format/Runtime

Feature • ~95 min • 2.39:1

Logline:

When a homeless couple (phroggers) stumble upon a seemingly abandoned house, they unknowingly step into a living nightmare orchestrated by a master manipulator who lures desperate creatives to their doom, sparking a deadly game of cat and mouse in a battle for survival and revenge.

Budget (target):

$1.1–1.5M

Status:

Packaging (director shortlist; casting in progress)

Financing / Sales Strategy:

Equity + tax incentive (20–40% eligible spend depending on state/country).

Pre-sales in select territories via sales agent once cast attaches.

Gap/mezz against signed pre-sales and incentives.

Distributor/Platform discussions post-festival premiere (hybrid theatrical/TVOD → SVOD window).

Hooks

Single-family home = contained production → high yield, tight schedule.

Phrogging twist (real-world fear) + smart-home surveillance for modern dread.

Two-hander survival engine with escalating cat-and-mouse set pieces.

Sound-led scares and practical effects > CG (festival-friendly, budget-smart).

Elevated comps: Hush, Don’t Breathe, The Rental, The Collector.

Rights & Deal Terms

License only — underlying film IP retained. Exclusive distribution by territory/term; merch/publishing/games excluded unless separately licensed.

Reversion: Non-payment of MG or no release within 12 months of delivery; audit rights standard.

Festival & Market Plan:

Premiere aim: Fantastic Fest / TIFF Midnight / SXSW / Tribeca Midnight.

Market: AFM (primary) + Cannes Marché meetings for early pre-sales; FrightFest / Sitges for genre buzz.

Market(s)

AFM (Los Angeles)

Frontières (Cannes / Fantasia)

Docuseries

Medical Access

Genre

Medical Access | Setting: U.S. hospitals & transplant networks

Premise:

Follows three patients through the transplant pipeline—from waitlist call to OR to recovery—intercut with surgical teams and coordinators racing the clock, ethics, and odds.

Format

6×45’ (international hour) — option to expand to 8×45’

Budget:

Season budget est. $750K (6×45’ ~ $125K/ep).

Hooks

High-stakes medical access with verité intimacy

Natural suspense engine: organ windows, match calls, post-op twists

Credible advisors; human-first storytelling over jargon

Comps: Lenox Hill, The Surgeons Cut, Emergency

Status

Packaging — hospital access & HIPAA releases in progress; 2–3 min sizzle in production; format locked

Rights & Deal Terms:

IP Retained: Series format, brand, future seasons, and underlying materials remain producer-owned.

Rights Offered (License): Exclusive broadcast/streaming rights by territory/term (6×45’ Season 1). Remake/format rights reserved unless optioned.

Holdbacks/Windows: As negotiated per platform/territory.

Financials: Commission/pre-sale + co-financing; eligibility-aligned grants/tax incentives; reporting & audit rights.

Approvals/Standards: Editorial standards statement; meaningful consultation on marketing; compliance with medical privacy (HIPAA or local equivalent).

Delivery/Assets: Standard factual deliverables + M&E; access/consent documentation on file; localization assets licensed for the Term only.

Reversion: If commissioning/pre-sale not executed by X date, no release within 12 months of delivery, or payment default/insolvency.

Financing / Co-Pro Ask:

Seeking commissioning broadcaster or pre-sales, a factual co-financing partner, eligibility-aligned tax incentives/grants, and brand/health-org underwriting (standards-compliant, no editorial control). Gap/mezz considered post pre-sales.

Market(s)

MIPCOM – Cannes

Detailed top sheet and post-incentive targets available under NDA.

Rights Notice: All deals are licenses for defined media/territories/terms.

Underlying IP remains with the producer/rightsholder.

Reversion, audit, and approval provisions apply.

INTERESTED?

GET IN TOUCH